The good news is that most of these monthly budget templates are free, and even the paid apps usually offer free trials.Whether you’re building a budget for the first time or you’re a seasoned saver, technology can make the process a lot easier.

#BUDGET PLANNING TEMPLATES TRIAL#

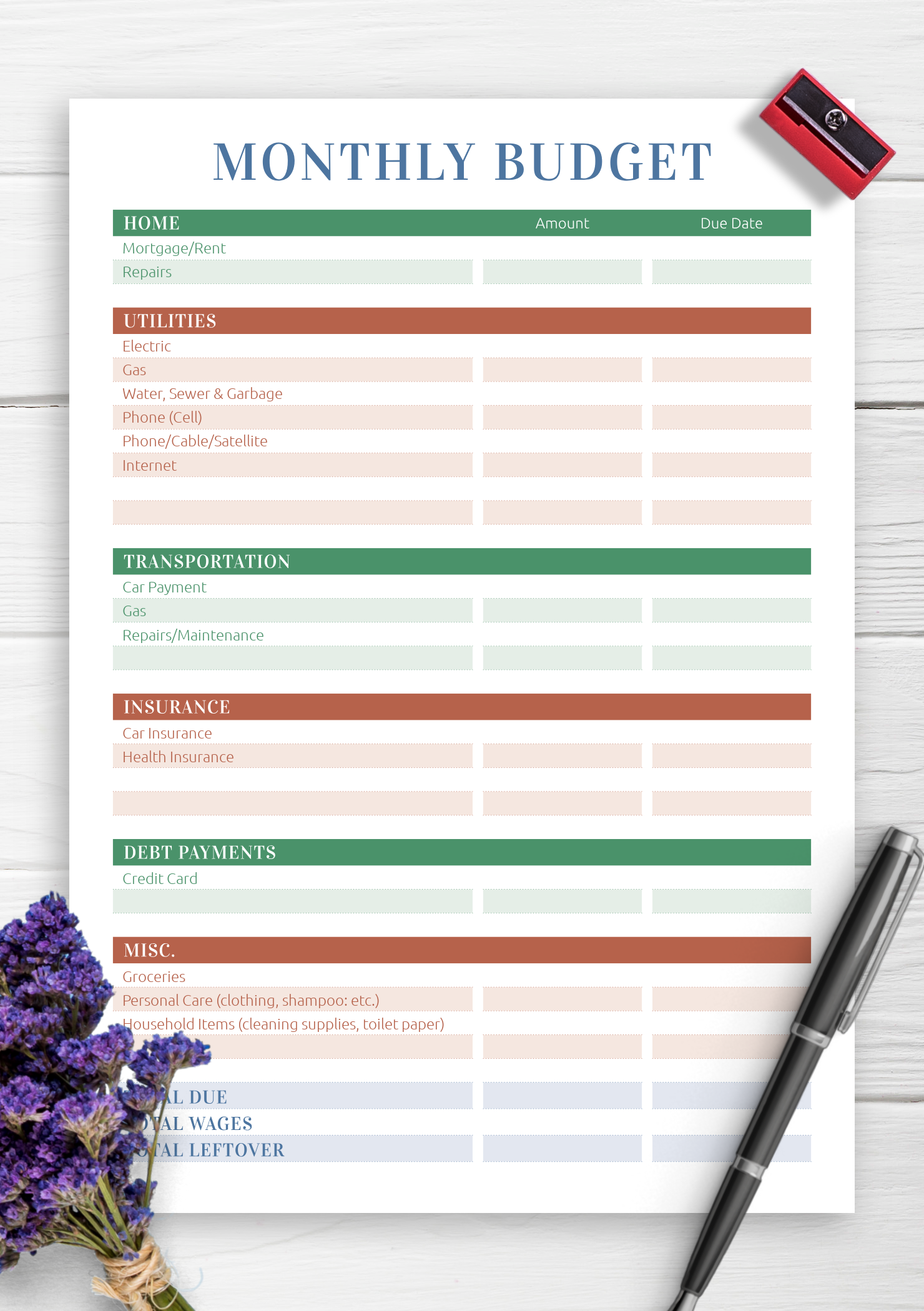

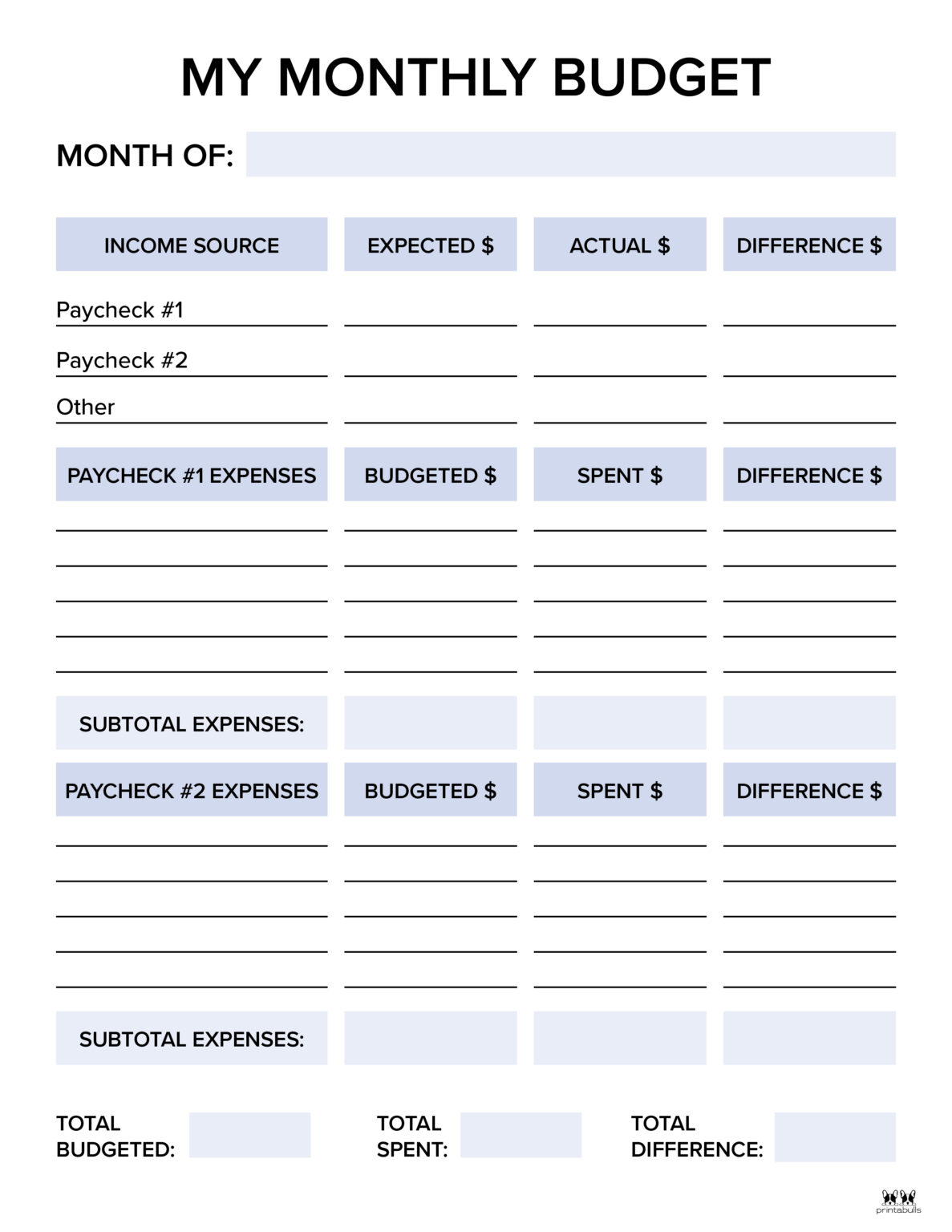

Sometimes it takes a little trial and error to find the best fit. Just pick one and give it a go! If it doesn’t work for you, you can always change things up later. So, which budget template is the best? As always, the best budgeting tool is the one you’ll use consistently. If you’re looking for something a little more substantial, though, one of the budget templates from the list above is bound to fit the bill. While it might not look pretty or do anything fancy, it gets the job done. In fact, our family still uses a good old-fashioned pen and paper. A place to record the difference between the twoĪ budget template can be as simple or sophisticated as you like.A place to record actual earnings and spending.Space to estimate your monthly earnings and expenses.They help track your money so you can make the most of what you have. How Does a Budget Template Work?īudget templates are tools that help you plan for your monthly income and expenses. Open a free Personal Capital account here. More importantly, Personal Capital also serves as an excellent complement to any of the budgeting tools listed here…and it is FREE! The free net worth tracking, investment analyzer tool, and free retirement calculators make it a wonderful alternative to programs like Mint.

The budgeting tool isn’t as powerful as some of the others, but it does automate tracking your cash flow for free.

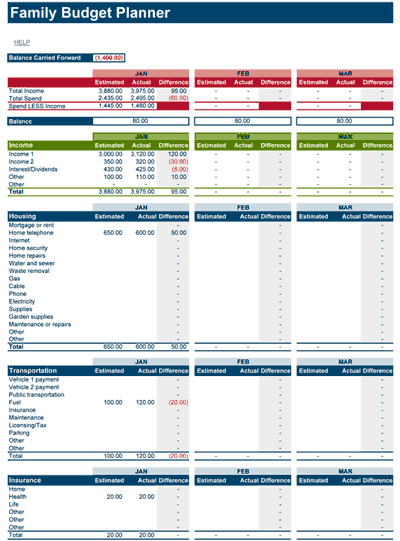

Personal Capital will automatically track your spending and show you where are you are relative to your budget. Instead, you create your spending categories, set your budget for each one, and link your bank accounts and credit cards. Unlike an Excel spreadsheet or a pen-and-paper budget, Personal Capital’s tool doesn’t require you to manually input your spending. Included in that mix is a free budget template that is digital. Personal Capital offers a robust (and free!) set of financial tracking tools. This setup is ideal for people who have a bunch of spending categories or for people who just prefer to track their spending at a very granular level.ĭownload the Cash Flow Formula here. If it’s negative, you’ve overspent.Īdditionally, I like the expanded version because it includes extra blank categories just waiting for your customization. If it’s positive, you have money to spend. That can be a real eye opener! After you enter those projections and input spending for each category, the balance tab keeps track of your position. Pop in your monthly income and your fixed expenses, and it tells you how much you have left to budget for variable expenses. The first is a given: It saves you time by doing the math for you. I personally dig the large spreadsheet for two reasons.

#BUDGET PLANNING TEMPLATES PDF#

The PDF is great if you want to print your budget template and stick it in a conspicuous place - like on your fridge. It’s available in three formats: a printable PDF, an interactive spreadsheet, and a larger version of the spreadsheet. The Cash Flow Formula from Money Peach helps you plan a zero-sum budget and track how your spending stacks up against your projections.

0 kommentar(er)

0 kommentar(er)