“It's meant to be a form of fundamental analysis,” says Wyand. Assuming either the former or the latter can hurt discounted cash flow analysis. Don’t Be Swayed by Current Market Assumptions on Growth: Good economic times can lull people into believing solid growth will continue indefinitely.If DCF is not giving you the numbers you like, don't overengineer it and keep working it until you get the numbers you like.” “I think one of the key things is to be honest with yourself. Sometimes you're like, ‘I'll change this assumption (in discounted cash flow analysis).’ And the reality is, people usually have a price in mind. And as bankers, we're very guilty of this. “Sometimes, you see people and they're spending days fiddling with the numbers. Be Objective and Honest About the Numbers: “Numbers just reflect reality, but they don't change it,” says Wyand.

#DISCOUNTED CASHFLOWS FREE#

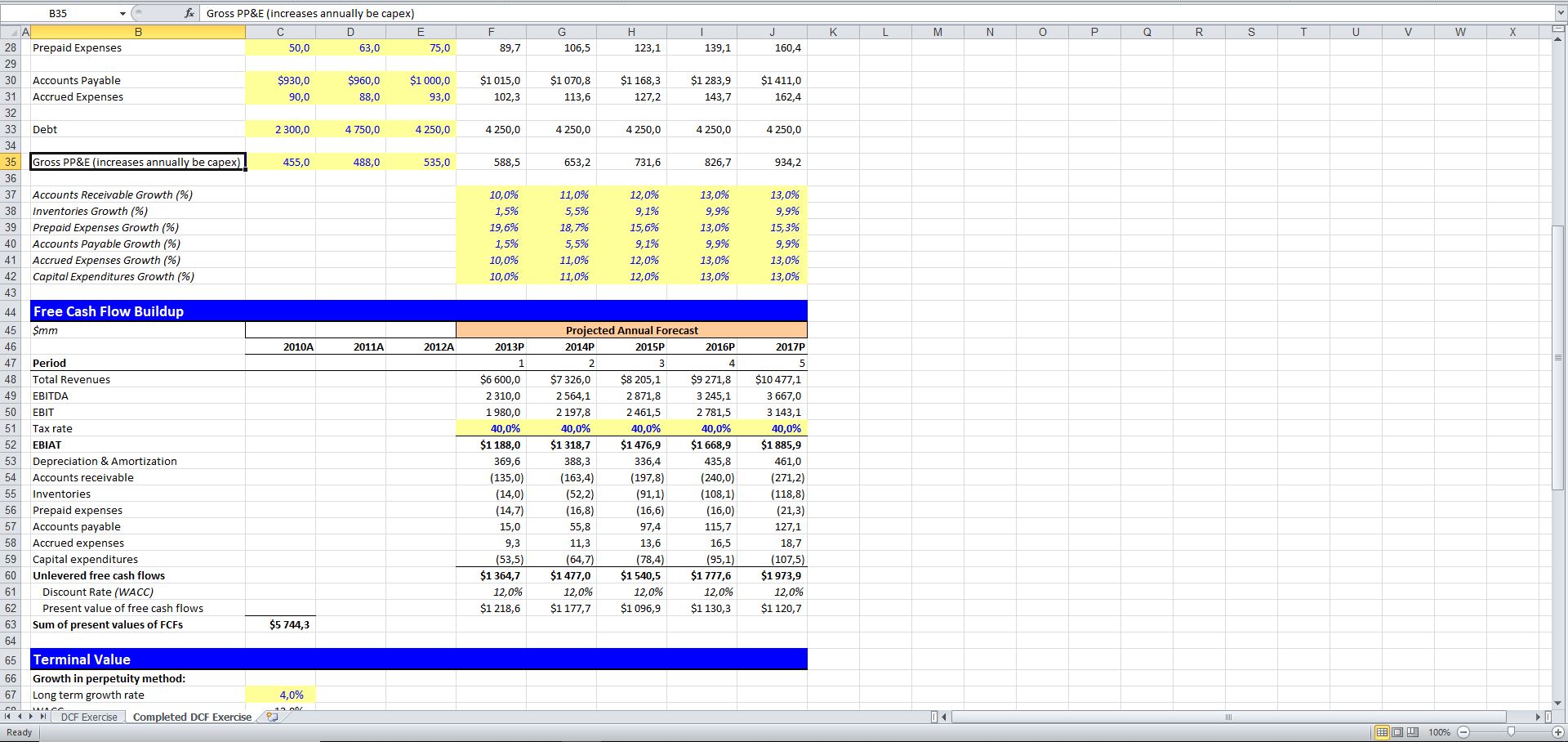

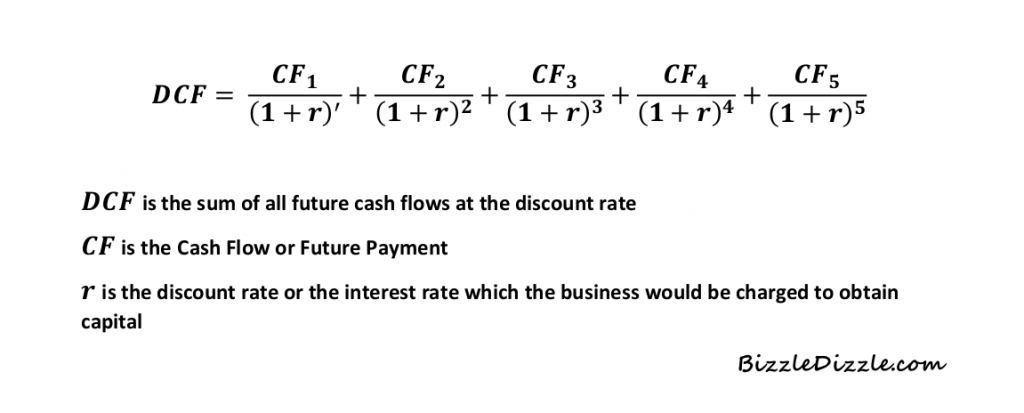

And over the next five to 10 years, I think we are going to see a shift away from crude linear free cash flow growth forecasts and a move toward something more correlation driven.” “In general, forecasting methodology is getting much more sophisticated. “Forecasting is a huge component of creating DCF - and what you usually find is that the valuation is extremely sensitive to the forecast assumptions,” says Ray Wyand, a former vice president of structured finance at Citibank and the current CEO of gini, which offers machine learning tools to help businesses improve the quality of their cash flow forecasting. The terms discounted cash flow analysis, discounted cash flow model, discounted cash flow technique, and discounted future cash flow are all synonymous with discounted cash flow, and all refer to valuing an investment based on future cash flow.

#DISCOUNTED CASHFLOWS HOW TO#

To learn more about cash flow analysis, visit “ The Basics of Operating Cash Flow: Tips, Formulas, and Examples.” To learn more about how to determine cash flow for a specific project, visit “ How to Master Project Cash Flow Analysis.” To learn how to create a cash flow forecast and to download templates that can help, visit “ How to Create a Cash Flow Forecast, with Templates and Examples.” And to download other templates for a free cash flow forecast, check out “ Free Cash Flow Forecast Templates.” What Is Discounted Cash Flow Analysis or a Discounted Cash Flow Model? In fact, as long as analysts can project likely future cash flows from each investment, they can use discounted cash flow to make apple-to-apple comparisons and assessments concerning a wide variety of investments. People use DCF to compare similar, or even different, types of investments. Analysts use the method to value a company, a stock, or an investment within a company.

Community Explore user-generated content and stay updated on our latest product features.Help and Learning A comprehensive knowledge base, including articles, tutorials, videos, and other resources that cover a range of topics related to using Smartsheet.Content Center Articles and guides about project management, collaboration, automation, and other topics to help you make the most of the Smartsheet platform.

0 kommentar(er)

0 kommentar(er)